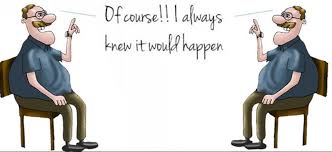

Did you ever notice that the events seem more predictable, after they have happened. For instance, you knew beforehand Mr. Modi would be winning the election in 2019. Things seem more obvious and predictable after they had happened. Let’s go through 2 more examples for better understanding.

A) In an important IPL match, we already knew which team is going to win. In fact that team ended win the match, boasting our overconfidence.

B) After watching the thriller movie, we are mostly convinced that we knew the mysterious person well before.

Hindsight bias is a psychological term also know as, “knew it all along phenomenon“. The bias is widely studied in economics behavior as it is a common failing among investors.

When it comes to speculation everyone wants to buy the stock at the bottom and sell at the top. It is not that easy to time the bottom or the top. People often end up regretting for selling too early, as after they sell the prices rise more. They end up thinking that they knew beforehand that after the sell the price is bound to soar. If the scenario turns out the other way then they are convinced too as they knew beforehand the price won’t rise more and they had already sold the shares. This ends up building overconfidence in the people and they become so called expert in predicting the future.

Our memory misremember the past decision and rationalize by observing the outcome to prove that we predicted that and ended up on the victory side. Our rationale thinking starts to deteriorate after it and we become more of a pundit without any rationale. Its a big trap for us as we refrain from correcting our mistakes and end up in a downward spiral until we are left with no cash.

Since now you know about the bias in us, next time be conscious to verify whether you are truly correct or is it the bias. To avoid the misremember thing you can note down your decision/speculation on a journal along side the rationale and date. It will surely help in the long run as it will enable you to avoid lots of big traps.

A big trap is a product of tiny small traps over a period of time.

Tweet

Sometimes

LikeLike