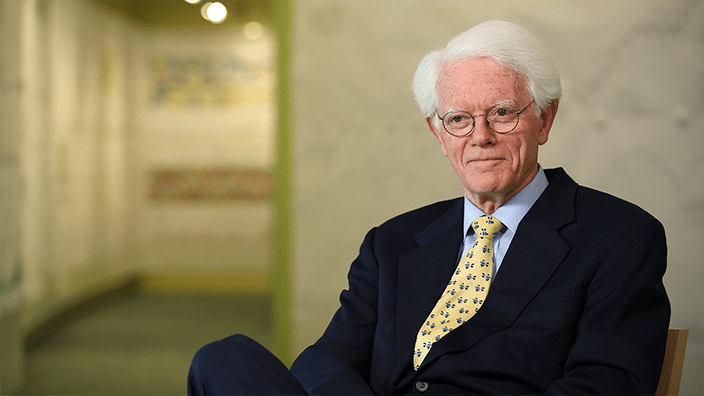

Peter Lynch is an American Investor , mutual fund manager and philanthropist. He is famous for managing the Magellan Fund at Fidelity. During his tenure from 1977-90, the asset under management grew from $18 million to whopping $14 billion, making it the world’s best performing mutual fund.

His strategy is simple but not easy. Buy what you use. Buy shares of those companies, which you use in your day to day life. You have a smart mobile in your hand having an airtel or Jio sim in it. But when it comes to buy a share you opt for Voda-Idea instead of Airtel or Jio. You go out with your friends watch movie at PVR or INOX and have pizza at Domino’s*. All three of them are listed companies in Indian exchange. However, when it come to buy shares, we never think of the products we use in our life. We can know about product and the company way before an analyst does. The analyst covers a company only after the shares jump at least 2 or 3 folds.

The strategy doesn’t mean, you blindly buy the share of the company after you find the product. You need to look at the few basic checklist point to make it qualify as a buy. For starter it makes the list narrow. Instead of running after the complex industries that we don’t understand,isn’t it good to buy stuff we understand. As human nature we assume complex things to me superior in nature, whereas it is the simple ones which is superior.

Whenever you see a product next time you can see the details like who is the manufacturer, is it a listed company? and various other valuable information on the packing labels. You may come across some company about which few investors know as the company is not covered in the mainstream yet.

Hope you find a gem soon!

*For Domino’s, Jubilant FoodWorks is the master Franchise in India.

Leave a comment