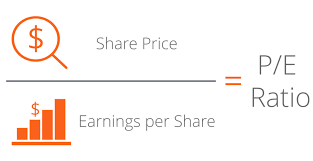

Price to Earning ration is the most sought ratio by the investors. Here the price refers to the current stock price of the company and the earning refers to the income made by the company in the last 12 months. This ratio generally gives us rough idea how’s the company doing. The ratio is generally higher for the growth companies as the investors believe the company to earn more in the comings months or years,pushing the prices higher.

For technology stock which generates revenue by burning cash, the p/e ratio doesn’t work for them, since the current earnings are in negative.

The ratio gives us the rough estimate of the time it will take to earn back the amount of one’s initial investment, assuming the income remain constant, which itself is not a fair assumption. Still the idea is to be aware how long will it take. It may save you from investing in a pity stock.

When we compare the p/e ration with the yearly growth of the company, it gives us more insight whether the company is low priced or high priced. For instance ABC’s P/E is 10 and it’s growth rate is 20% yearly. Assuming, the company will be growing on the same scale, the stock is cheap to buy at the current price. If the ratio between growth and p/e is greater than 1 it is considered as cheap stock and vice versa. Though the assumption doesn’t turn out well. There is ups and downs in the market all the time.

Leave a comment