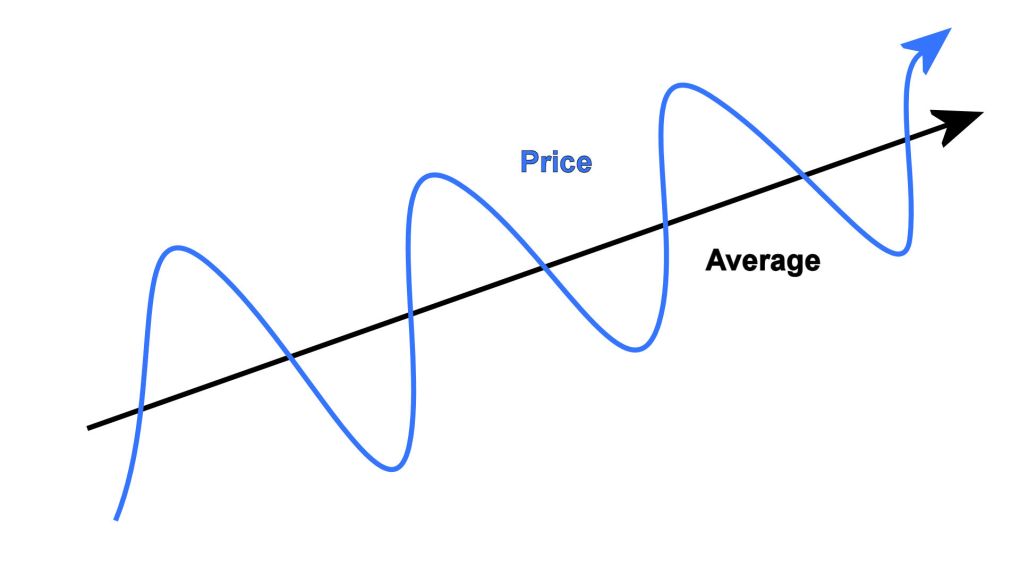

Mean Reversion is a finance theory which suggests that the price of an asset will eventually return to its average level of entire dataset. When the price of a stock is below its average price, the buyers consider it attractive for purchase and anticipate the prices to rise in the short run. On the other hand for highly priced stocks than the average price, the market price is expected to fall. The average price can be calculated by taking an average for last 50 days or 100 days depending on your technical analysis of the stock.

Mean reversion tried to capitalize on extreme changes in the pricing of a particular stock. However, it doesn’t guarantee the return to normal pattern for each and every stock. There might be permanent shift in the norm depending on the company’s performance. The market is unstable in short term and stable in the long term.

Life is full of ups and downs. You might be high on sky when the things go well and low under the ground when things go west. In the long run, if one continues to work with determined mindset, one mostly achieves the desired goals/dreams. We have the habit of taking the things to extreme whether it be success or failure. It is simple to be normal but not easy.

A bad mood turns good and good turns bad. It is a life long process. There is day after night and night after day. The tiny habits performed daily shows the little miracles after a period of time. The temperature of water needs to reach 100 degree Celsius before boiling. It doesn’t reach 100 just in a moment. It needs to grow from the current temperature say 25 one by one to 100. It doesn’t mean the previous steps doesn’t have any impact. But our focus is only on 100 as miracle happens at 100 not at 99 or any other number.

Its all about making the permanent shift progressively instead of reverting back to mean.

Tweet

Leave a comment